2025 Tax Code Changes: Optimize US Investor Returns

Navigating the 2025 tax code changes is crucial for US investors seeking to optimize returns, requiring proactive planning and strategic adjustments to investment portfolios and financial approaches to minimize liabilities.

As the calendar pages turn towards 2025, US investors find themselves at a critical juncture, facing potential shifts in the tax landscape that could significantly impact their financial strategies. Understanding and adapting to these impending changes is not merely an option but a necessity for those aiming to optimize returns and safeguard their wealth. This article delves into Navigating the 2025 Tax Code Changes: 7 Key Strategies for US Investors to Optimize Returns, offering actionable insights to help you prepare and thrive in the evolving fiscal environment.

Understanding the Looming 2025 Tax Code Shifts

The year 2025 is poised to bring significant alterations to the US tax code, primarily due to the expiration of various provisions from the Tax Cuts and Jobs Act (TCJA) of 2017. These expirations will affect individual income tax rates, deductions, and certain investment-related taxes, creating both challenges and opportunities for investors. Proactive engagement with these changes is paramount to ensure your financial plan remains robust and efficient.

Many of the individual income tax rate reductions are set to revert to pre-TCJA levels, potentially pushing some taxpayers into higher brackets. This shift could influence everything from earned income to capital gains, making it essential to understand how your overall tax burden might change. Beyond income taxes, various deductions and exemptions could also see adjustments, impacting your taxable income.

Key Expirations and Their Impact

Several critical provisions are slated to expire, directly influencing investment decisions and overall financial planning. Being aware of these specific changes allows for targeted adjustments to your strategies.

- Individual Income Tax Rates: The current lower rates are temporary, and their expiration could mean higher marginal tax rates for many.

- Standard Deduction Amounts: The increased standard deduction amounts are also set to revert, which might reduce the tax benefit for those who currently don’t itemize.

- Estate and Gift Tax Exemptions: The generous exemption amounts under the TCJA are expected to be significantly reduced, impacting high-net-worth individuals and their estate planning.

- Qualified Business Income (QBI) Deduction: The 20% deduction for qualified business income for pass-through entities is also set to expire, affecting many small business owners and investors in such entities.

The cumulative effect of these expirations could lead to a higher tax bill for many investors. Therefore, a comprehensive review of your current financial situation in light of these potential changes is not just advisable, but critical. Understanding these shifts allows for informed decision-making and the development of strategies to mitigate adverse effects.

In essence, the upcoming tax code shifts are not just minor adjustments; they represent a significant recalibration of the tax landscape. Investors who take the time to understand these changes and their potential ramifications will be better positioned to adapt their portfolios and strategies effectively, minimizing potential liabilities and optimizing their financial outcomes.

Strategy 1: Re-evaluating Your Asset Allocation and Diversification

As the tax code evolves, so too should your approach to asset allocation and diversification. The tax implications of various asset classes can change dramatically, making it crucial to reassess your portfolio mix. What was tax-efficient yesterday might not be tomorrow, necessitating a strategic pivot to maintain optimal after-tax returns.

Consider how different investment vehicles are taxed. For instance, ordinary income rates apply to interest from bonds, while qualified dividends and long-term capital gains often receive preferential rates. If income tax rates increase, the relative attractiveness of tax-efficient growth investments might rise. This review isn’t just about minimizing taxes; it’s about maximizing your net gains, which demands a holistic view of your portfolio’s tax efficiency.

Tax-Efficient Asset Placement

Strategic placement of assets within different account types can significantly reduce your tax burden. This involves understanding which assets are best suited for taxable accounts versus tax-advantaged accounts.

- Taxable Accounts: Consider placing investments that generate qualified dividends or long-term capital gains, as these are often taxed at lower rates. Growth stocks with minimal current income are also good candidates.

- Tax-Deferred Accounts (e.g., 401(k), Traditional IRA): These accounts are ideal for assets that generate high ordinary income, such as bonds, REITs, or actively managed funds with high turnover, as taxes are deferred until withdrawal.

- Tax-Exempt Accounts (e.g., Roth IRA, HSA): Assets with high growth potential are excellent for Roth accounts, as qualified withdrawals are entirely tax-free. Health Savings Accounts (HSAs) offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Diversification remains a cornerstone of prudent investing, but its tax implications also need scrutiny. A well-diversified portfolio that is also tax-efficient considers the tax treatment of each component. This means looking beyond just market risk and understanding the tax risk associated with your investment choices. Regularly reviewing and adjusting your asset allocation based on the changing tax environment is a dynamic process that can lead to substantial long-term benefits.

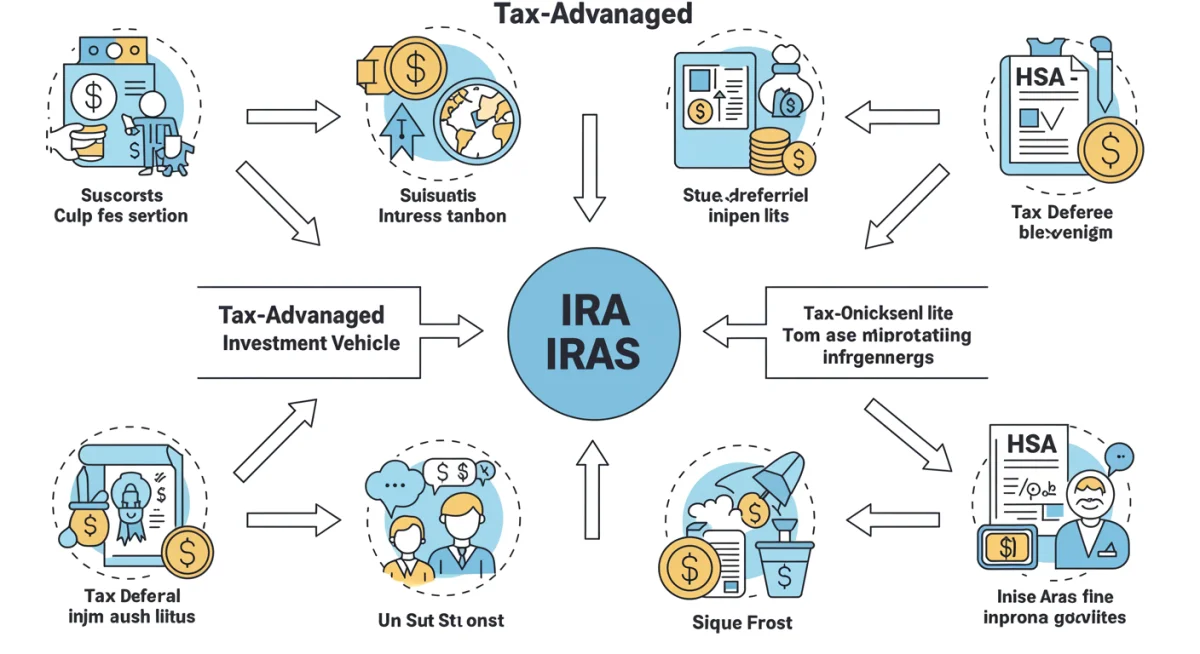

Strategy 2: Maximizing Tax-Advantaged Investment Vehicles

One of the most effective ways for US investors to optimize returns in the face of changing tax codes is by fully utilizing tax-advantaged investment vehicles. These accounts offer significant benefits, such as tax deferral, tax-free growth, or tax-deductible contributions, which can become even more valuable if tax rates rise in 2025.

Many investors often underutilize these powerful tools, leaving significant tax savings on the table. Maximizing contributions to retirement accounts, health savings accounts, and other similar vehicles should be a top priority. These accounts not only help you save for the future but also provide immediate or long-term tax relief, depending on their structure.

Key Tax-Advantaged Options

Several types of accounts offer distinct tax advantages, each suitable for different financial goals and investor profiles. Understanding their nuances is key to leveraging them effectively.

- 401(k)s and IRAs: These are foundational retirement accounts. Traditional 401(k)s and IRAs offer tax-deductible contributions, deferring taxes until retirement. Roth versions, conversely, offer tax-free withdrawals in retirement, provided certain conditions are met. Maxing out these contributions can significantly reduce your current taxable income and allow investments to grow unburdened by annual taxes.

- Health Savings Accounts (HSAs): Often called the “triple tax advantage” account, HSAs allow for tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. For those with high-deductible health plans, HSAs are an unparalleled investment tool, especially if healthcare costs continue to rise.

- 529 Plans: For educational savings, 529 plans offer tax-free growth and tax-free withdrawals for qualified educational expenses. While contributions are not federally tax-deductible, many states offer deductions or credits for contributions, making them an excellent choice for future education costs.

The strategic use of these vehicles can shelter a substantial portion of your investment gains from immediate taxation, allowing your capital to compound more rapidly. With potential tax rate increases on the horizon, the ability to defer or avoid taxes altogether becomes an even more powerful component of your overall investment strategy. Regularly reviewing contribution limits and ensuring you are maximizing these opportunities is a critical step in tax optimization.

Strategy 3: Strategic Tax-Loss Harvesting and Gain Management

Tax-loss harvesting is a time-tested strategy that involves selling investments at a loss to offset capital gains and, potentially, a limited amount of ordinary income. This tactic becomes particularly valuable when tax rates are volatile or expected to increase, as it allows investors to manage their tax liabilities proactively.

In a dynamic market environment, opportunities for tax-loss harvesting can arise frequently. By strategically realizing losses, you can reduce your taxable capital gains for the year. If your capital losses exceed your capital gains, you can use up to $3,000 of the remaining loss to offset ordinary income, with any excess carried forward to future years. This forward-looking benefit makes it a powerful tool for long-term tax planning.

Optimizing Your Capital Gains and Losses

Effective management of capital gains and losses requires careful timing and an understanding of wash-sale rules. It’s not just about selling at a loss; it’s about doing so intelligently to maximize tax benefits.

- Timing Your Sales: Consider selling losing positions towards the end of the year, or whenever market conditions present an opportunity, to offset realized gains from other investments.

- Understanding Wash-Sale Rules: Be mindful of the wash-sale rule, which prevents you from claiming a loss if you buy a substantially identical security within 30 days before or after the sale.

- Offsetting Ordinary Income: Remember the $3,000 limit for offsetting ordinary income with net capital losses. This can be a significant benefit, especially for those in higher tax brackets.

Beyond harvesting losses, managing your capital gains is equally important. If you anticipate higher capital gains tax rates in 2025, consider realizing some long-term capital gains in 2024 if it aligns with your financial plan and current tax bracket. Conversely, if you expect to be in a lower tax bracket in 2025, deferring gains might be beneficial. This strategic approach to both gains and losses is paramount for minimizing your overall tax burden and optimizing investment outcomes.

Strategy 4: Exploring Municipal Bonds and Other Tax-Exempt Investments

For investors particularly concerned about rising income tax rates, municipal bonds offer an attractive avenue for generating tax-exempt income. Interest earned on municipal bonds is typically exempt from federal income tax, and often from state and local taxes if you reside in the issuing state. This tax advantage can significantly boost your after-tax return, especially for those in higher tax brackets.

The appeal of municipal bonds tends to increase as federal income tax rates rise, making their tax-exempt yield more valuable compared to taxable alternatives like corporate bonds or Treasury securities. While their pre-tax yields might be lower, their after-tax equivalent yield can be highly competitive, providing a stable income stream without the drag of taxation.

Benefits of Tax-Exempt Options

Beyond municipal bonds, other investment vehicles offer tax advantages that can be strategically employed to shield income from taxation.

- Federal Tax Exemption: The primary benefit of municipal bonds is the exemption of interest income from federal income tax. This can translate into substantial savings, particularly for high-income earners.

- State and Local Tax Exemption: For bonds issued within your state of residence, the interest is often also exempt from state and local income taxes, providing a ‘triple tax-free’ benefit.

- Reduced Taxable Income: By investing in tax-exempt securities, you effectively reduce your adjusted gross income (AGI), which can have a cascading effect on other tax-related calculations and eligibility for certain deductions or credits.

When considering municipal bonds, it’s crucial to assess their credit quality and align them with your risk tolerance and investment horizon. While generally considered lower risk, default can occur. Additionally, consider bond laddering strategies to manage interest rate risk. Exploring other tax-exempt investments, such as certain types of annuities or life insurance policies (though these come with their own complexities), can also be part of a comprehensive tax-efficient strategy. The goal is to identify and utilize investments that allow your income to grow with minimal tax erosion.

Strategy 5: Proactive Estate and Gift Tax Planning

With the potential reduction in estate and gift tax exemptions in 2025, proactive planning becomes critical for high-net-worth individuals. The current generous exemption amounts, which allow for substantial tax-free transfers during life or at death, are set to revert to much lower levels. This change could significantly increase the tax burden on estates and gifts, making early planning indispensable.

The expiration of the higher exemption amounts means that more estates could become subject to federal estate tax, and more gifts could trigger gift tax liabilities. Therefore, understanding the current rules and anticipating the future changes allows for strategic actions today that can preserve wealth for future generations.

Key Estate Planning Considerations

Revisiting your estate plan is crucial to adapt to the potential changes. This involves more than just updating a will; it encompasses a broader review of your asset transfer strategies.

- Utilizing Current Exemption Amounts: If you have significant wealth, consider making substantial gifts under the current higher exemption limits before they potentially decrease. This could involve direct gifts or funding trusts.

- Reviewing Trust Structures: Existing trusts might need to be reviewed and potentially restructured to remain tax-efficient under the new rules. Consider irrevocable trusts for specific assets.

- Dynasty Planning: For multi-generational wealth transfer, explore strategies like dynasty trusts that can benefit from current exemptions and potentially grow tax-free for extended periods.

- Charitable Giving Strategies: Incorporate charitable giving into your estate plan, as it can reduce your taxable estate while supporting causes you care about. Donor-advised funds or charitable remainder trusts are effective tools.

Engaging with an experienced estate planning attorney and tax advisor is essential to navigate these complexities. They can help you understand the specific implications for your estate and guide you in implementing strategies that align with your financial goals and minimize future tax liabilities. Proactive estate and gift tax planning today can prevent significant tax erosion tomorrow, ensuring your legacy is preserved as intended.

Strategy 6: Reviewing and Adjusting Retirement Contribution Strategies

Retirement contributions are a cornerstone of long-term financial planning, and their tax benefits are often substantial. As the tax code changes in 2025, a thorough review and adjustment of your contribution strategies become essential. This ensures you continue to maximize tax advantages while aligning with your overall retirement goals.

The choice between traditional (pre-tax) and Roth (after-tax) contributions, for example, is heavily influenced by current and anticipated future tax rates. If income tax rates are expected to rise, Roth contributions might become more appealing due to their tax-free withdrawal status in retirement. Conversely, if you expect to be in a lower tax bracket in retirement, traditional contributions might offer greater immediate tax savings.

Optimizing Your Retirement Savings

Beyond the traditional vs. Roth decision, several other aspects of retirement contribution strategies warrant attention in light of impending tax changes.

- Maximizing Catch-Up Contributions: If you are aged 50 or older, ensure you are taking advantage of catch-up contributions to 401(k)s and IRAs. These additional contributions can provide significant tax deferral or tax-free growth.

- Backdoor Roth Conversions: For high-income earners who exceed Roth IRA contribution limits, the backdoor Roth conversion strategy remains a viable option. This involves contributing to a non-deductible traditional IRA and then converting it to a Roth IRA.

- Employer-Sponsored Plans: Fully utilize any employer match offered in your 401(k) or similar plan. This is essentially free money and a guaranteed return on your investment, regardless of tax changes.

- Self-Employed Retirement Plans: If you are self-employed, explore options like SEP IRAs or Solo 401(k)s, which allow for much higher contribution limits than traditional IRAs, offering substantial tax deferral.

Regularly consulting with a financial advisor can help you navigate these choices and ensure your retirement contribution strategy is optimized for the current and future tax environment. The goal is to build a robust retirement nest egg while minimizing the tax bite, both now and in the future. Adjusting your strategy proactively can lead to substantial long-term savings and a more secure retirement.

Strategy 7: Consulting with a Qualified Tax Professional

While understanding the potential 2025 tax code changes and implementing general strategies is valuable, the complexities of tax law often necessitate personalized advice. Consulting with a qualified tax professional is arguably the most crucial strategy for US investors seeking to truly optimize their returns and ensure compliance.

Tax laws are intricate and subject to interpretation, and what works for one investor might not be ideal for another due to differing financial situations, investment portfolios, and personal goals. A tax professional can provide tailored guidance, identify specific opportunities and risks, and help you navigate the nuances of the evolving tax landscape.

Benefits of Professional Guidance

Engaging a tax professional offers several distinct advantages that can significantly enhance your tax planning and investment outcomes.

- Personalized Advice: A professional can analyze your unique financial situation and recommend strategies specifically tailored to your needs, rather than generic advice.

- Up-to-Date Knowledge: Tax laws are constantly changing. A qualified professional stays current with the latest regulations, ensuring your plan remains compliant and optimized.

- Identifying Missed Opportunities: You might be overlooking deductions, credits, or investment strategies that a tax expert would readily identify, leading to substantial savings.

- Risk Mitigation: Proper tax planning helps minimize the risk of audits, penalties, and other compliance issues, providing peace of mind.

- Complex Transaction Support: For complex investment transactions, real estate dealings, or business ventures, a tax professional can provide invaluable guidance to minimize tax implications.

Do not underestimate the value of expert advice, especially when significant tax code changes are on the horizon. The fees associated with professional tax planning are often outweighed by the tax savings and peace of mind gained. Schedule a consultation early to review your current financial plan, discuss the potential impact of the 2025 changes, and formulate a proactive strategy that positions you for optimal financial success.

| Key Strategy | Brief Description |

|---|---|

| Re-evaluate Asset Allocation | Adjust portfolio mix for tax efficiency, considering potential rate changes on different asset classes. |

| Maximize Tax-Advantaged Accounts | Fully utilize 401(k)s, IRAs, and HSAs to defer or exempt taxes on growth and withdrawals. |

| Strategic Tax-Loss Harvesting | Sell losing investments to offset capital gains and limited ordinary income, carrying forward excess losses. |

| Proactive Estate Planning | Utilize current higher exemption limits for gifts and trusts before potential reductions in 2025. |

Frequently Asked Questions About 2025 Tax Changes

The primary changes expected in 2025 stem from the expiration of several provisions of the Tax Cuts and Jobs Act of 2017. These include potential reverts to higher individual income tax rates, adjustments to standard deduction amounts, and significant reductions in estate and gift tax exemptions, directly impacting investment strategies and overall tax liabilities for US investors.

Tax-loss harvesting allows you to strategically sell investments at a loss to offset realized capital gains from other investments. This can reduce your overall taxable income. If tax rates increase in 2025, utilizing losses to reduce taxable gains or offset up to $3,000 of ordinary income in current or future years becomes even more valuable for optimizing returns.

The decision between Roth and traditional contributions depends on your individual circumstances and expected future tax rates. If you anticipate being in a higher tax bracket in retirement than you are currently, Roth contributions (tax-free withdrawals) may be more beneficial. If tax rates are expected to rise generally, Roth accounts become more attractive for their tax-free growth.

Municipal bonds offer interest income that is typically exempt from federal income tax, and often from state and local taxes if issued in your state of residence. If individual income tax rates increase in 2025, the tax-exempt nature of municipal bonds makes them a more attractive option for generating stable, tax-free income, especially for investors in higher tax brackets.

It’s advisable to consult a qualified tax professional as soon as possible, ideally before the end of 2024. This allows ample time to review your current financial situation, understand the specific implications of the 2025 tax code changes for your investments, and implement proactive strategies to optimize your returns and minimize potential tax liabilities effectively.

Conclusion

The impending 2025 tax code changes represent a critical moment for US investors to reassess and refine their financial strategies. By proactively understanding the potential shifts in income, capital gains, and estate taxes, and by implementing the seven key strategies outlined, investors can not only mitigate potential liabilities but also uncover new opportunities for optimizing their returns. From re-evaluating asset allocation and maximizing tax-advantaged vehicles to strategic tax-loss harvesting and professional consultation, each step is vital in building a resilient and tax-efficient portfolio. The future of your financial well-being depends on informed decision-making and timely action today.